Uniswap V1

背景介绍

UniswapV1 pool只允许创建Token/ETH交易对- 流动性代币实际就是

ERC20代币,支持转账 - 交易池支持直接的

Token/ETH计算兑换 Token/Token之间的兑换需要不同的交易池参与,以ETH为锚点执行兑换

- 流动性代币实际就是

Exchange

任何人通过提供 ETH/ERC20 代币提供流动性,流动性代币在提供流动性时 mint,在退款时 burn

增加流动性

- public: [addLiquidity(min_liquidity: uint256, max_tokens: uint256, deadline: timestamp)]

- 初次添加流动性:

ETH/Token直接作为交易对存储在池子ETH余额就是当前池子的流动性代币数量

- 非初次添加流动性:

- 以用户提供的

ETH为锚点,计算应该提供的相匹配的Token数量和mint出来的流动性代币数量 - 用户自定义的滑点控制交易,确保

Token数量不会超限 - 确保最终流动性代币的数量不会过低

- 以用户提供的

@public

@payable

def addLiquidity(min_liquidity: uint256, max_tokens: uint256, deadline: timestamp) -> uint256:

assert deadline > block.timestamp and (max_tokens > 0 and msg.value > 0)

total_liquidity: uint256 = self.totalSupply

if total_liquidity > 0:

// 允许用户自定义滑点,确保最终获得的流动性在滑点范围内

assert min_liquidity > 0

// 当前池子交易对中的ETH数量

eth_reserve: uint256(wei) = self.balance - msg.value

// 当前池子交易对中的Token数量

token_reserve: uint256 = self.token.balanceOf(self)

// 按照当前交易提供的 ETH 数量 和池子余额来计算应该添加的Token数量,数值向上取整

// 要求匹配的Token 数量小于用户自定义的Token最大值

token_amount: uint256 = msg.value * token_reserve / eth_reserve + 1

// 按照当前交易提供的 ETH数量 和目前池子中的流动性代币数量来计算最终获得的流动性,数值向下取整

// 要求最终流动性的值大于用户期望的最小值

liquidity_minted: uint256 = msg.value * total_liquidity / eth_reserve

assert max_tokens >= token_amount and liquidity_minted >= min_liquidity

// mint 流动性代币

self.balances[msg.sender] += liquidity_minted

self.totalSupply = total_liquidity + liquidity_minted

// 将Token代币添加到流动池

assert self.token.transferFrom(msg.sender, self, token_amount)

// 抛出事件

log.AddLiquidity(msg.sender, msg.value, token_amount)

log.Transfer(ZERO_ADDRESS, msg.sender, liquidity_minted)

return liquidity_minted

else:

// 初次添加流动性

// 判断当前工厂合约、Token合约的合法性

// 初次添加流动性,要求最少的ETH数量为 1 GWEI

assert (self.factory != ZERO_ADDRESS and self.token != ZERO_ADDRESS) and msg.value >= 1000000000

// 判断交易池的合约地址,只能添加当前池子Token代币

assert self.factory.getExchange(self.token) == self

// 初次添加流动性时,将全部代币转入流动性池

token_amount: uint256 = max_tokens

// 初次添加流动性时,将ETH转账额作为Token的初始交易对。

// ETH 初次额度就是当前交易池的流动性

initial_liquidity: uint256 = as_unitless_number(self.balance)

self.totalSupply = initial_liquidity

// 将流动性代币 mint 到交易发送地址

self.balances[msg.sender] = initial_liquidity

// 将Token代币添加到交易池

assert self.token.transferFrom(msg.sender, self, token_amount)

// 抛出事件

log.AddLiquidity(msg.sender, msg.value, token_amount)

log.Transfer(ZERO_ADDRESS, msg.sender, initial_liquidity)

return initial_liquidity

移除流动性

- public: [removeLiquidity(amount: uint256, min_eth: uint256(wei), min_tokens: uint256, deadline: timestamp)]

- 移除流动性

- 以用户提供的流动性代币数量为锚点,计算应该退还的

ETH和Token数量 - 用户自定义滑点,确保退换的

ETH 和 Token满足用户期望

- 以用户提供的流动性代币数量为锚点,计算应该退还的

@public

def removeLiquidity(amount: uint256, min_eth: uint256(wei), min_tokens: uint256, deadline: timestamp) -> (uint256(wei), uint256):

assert (amount > 0 and deadline > block.timestamp) and (min_eth > 0 and min_tokens > 0)

total_liquidity: uint256 = self.totalSupply

assert total_liquidity > 0

// 交易池中Token的总数量

token_reserve: uint256 = self.token.balanceOf(self)

// 根据移除的流动性代币数量占据总流动性的比例,计算池子中应该退回的ETH数量

eth_amount: uint256(wei) = amount * self.balance / total_liquidity

// 根据移除的流动性代币数量占据总流动性的比例,计算池子中应该退回的Token数量

token_amount: uint256 = amount * token_reserve / total_liquidity

//根据用户自定义的滑点,确保退换的ETH 和 Token在可接受的范围内

assert eth_amount >= min_eth and token_amount >= min_tokens

// 去除流动性

self.balances[msg.sender] -= amount

self.totalSupply = total_liquidity - amount

// 退还 ETH

send(msg.sender, eth_amount)

// 退还Token代币

assert self.token.transfer(msg.sender, token_amount)

// 抛出事件

log.RemoveLiquidity(msg.sender, eth_amount, token_amount)

log.Transfer(msg.sender, ZERO_ADDRESS, amount)

return eth_amount, token_amount

根据交易池输入计算输出

$$\Delta y = \frac{y r \Delta x}{x + r \Delta x}$$

UniswapV1 交易会抽取0.3%的手续费,作为提供流动性的奖励(计算恒定乘积的时候扣除手续费,但是交易池整体的余额增加,导致整体的乘积上涨,每笔交易都会让恒定乘积上涨。)

private: [getInputPrice(input_amount: uint256, input_reserve: uint256, output_reserve: uint256)]

@private

@constant

def getInputPrice(input_amount: uint256, input_reserve: uint256, output_reserve: uint256) -> uint256:

assert input_reserve > 0 and output_reserve > 0

// 输入的资产需要扣除一部分手续费

input_amount_with_fee: uint256 = input_amount * 997

numerator: uint256 = input_amount_with_fee * output_reserve

denominator: uint256 = (input_reserve * 1000) + input_amount_with_fee

return numerator / denominator

根据交易池输出反推输入

$$\Delta x = \frac{x \Delta y}{r(y - \Delta y)}$$

private: [getOutputPrice(output_amount: uint256, input_reserve: uint256, output_reserve: uint256)]

@private

@constant

def getOutputPrice(output_amount: uint256, input_reserve: uint256, output_reserve: uint256) -> uint256:

assert input_reserve > 0 and output_reserve > 0

numerator: uint256 = input_reserve * output_amount * 1000

denominator: uint256 = (output_reserve - output_amount) * 997

return numerator / denominator + 1

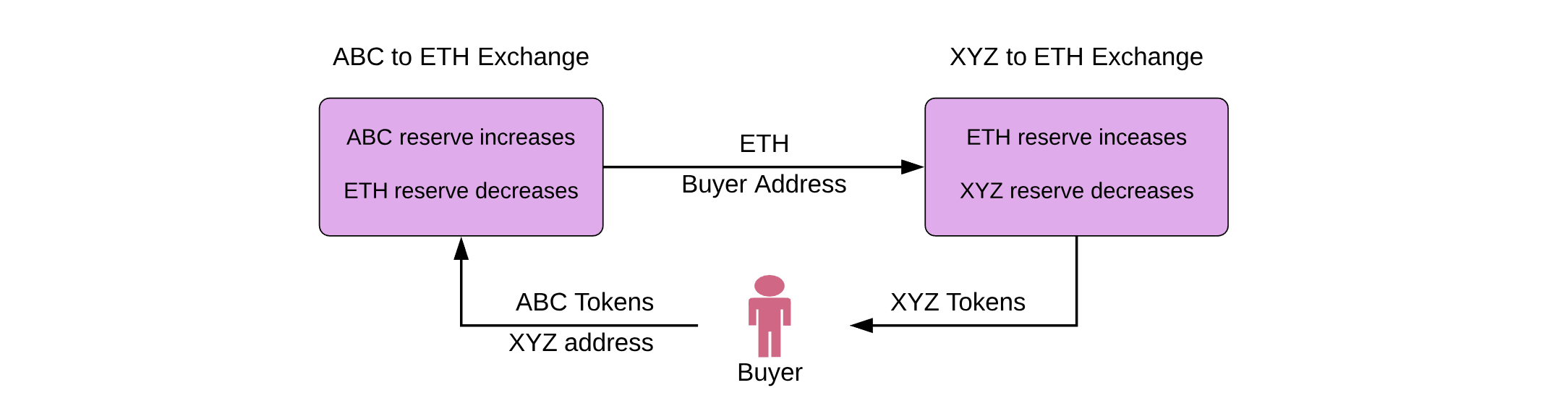

多个交易池兑换Token

用户进行 Token-Token 的 Swap,根据不同交易池的 ETH 锚定数量

@public

def tokenToEthTransferOutput(eth_bought: uint256(wei), max_tokens: uint256, deadline: timestamp, recipient: address) -> uint256:

assert recipient != self and recipient != ZERO_ADDRESS

return self.tokenToEthOutput(eth_bought, max_tokens, deadline, msg.sender, recipient)

@private

def tokenToTokenInput(tokens_sold: uint256, min_tokens_bought: uint256, min_eth_bought: uint256(wei), deadline: timestamp, buyer: address, recipient: address, exchange_addr: address) -> uint256:

assert (deadline >= block.timestamp and tokens_sold > 0) and (min_tokens_bought > 0 and min_eth_bought > 0)

assert exchange_addr != self and exchange_addr != ZERO_ADDRESS

token_reserve: uint256 = self.token.balanceOf(self)

// 通过输入计算预期输出

// 卖出TokenA,计算预期的ETH数量

eth_bought: uint256 = self.getInputPrice(tokens_sold, token_reserve, as_unitless_number(self.balance))

wei_bought: uint256(wei) = as_wei_value(eth_bought, 'wei')

assert wei_bought >= min_eth_bought

assert self.token.transferFrom(buyer, self, tokens_sold)

// 根据卖出的ETH,购入TokenB

tokens_bought: uint256 = Exchange(exchange_addr).ethToTokenTransferInput(min_tokens_bought, deadline, recipient, value=wei_bought)

log.EthPurchase(buyer, tokens_sold, wei_bought)

return tokens_bought

Reference

https://hackmd.io/C-DvwDSfSxuh-Gd4WKE_ig

https://github.com/Uniswap/v1-contracts/blob/master/contracts/uniswap_exchange.vy